Lextegrity's industry-leading Compliance Monitoring software provides compliance and audit teams with a comprehensive view of transactional spend and revenue risk across their organization. The software monitors transactions for risks, including corruption, fraud, asset misappropriation, revenue recognition, export controls, sanctions violations, and conflicts of interest.

Our algorithm incorporates a library of techniques targeting corruption, fraud, asset misappropriation, revenue recognition, export controls, and conflicts of interest, as well as advanced outlier detection and trending, to detect risk within your company’s disbursements, expenses, and revenue.

Tweak your analytical settings to match your company’s risk profile and needs with no technical skill needed to enable our risk engine to generate more relevant risk scores and expose the transactions that present the most risk.

We use machine learning to improve the risk engine scoring and anomaly detection over time.

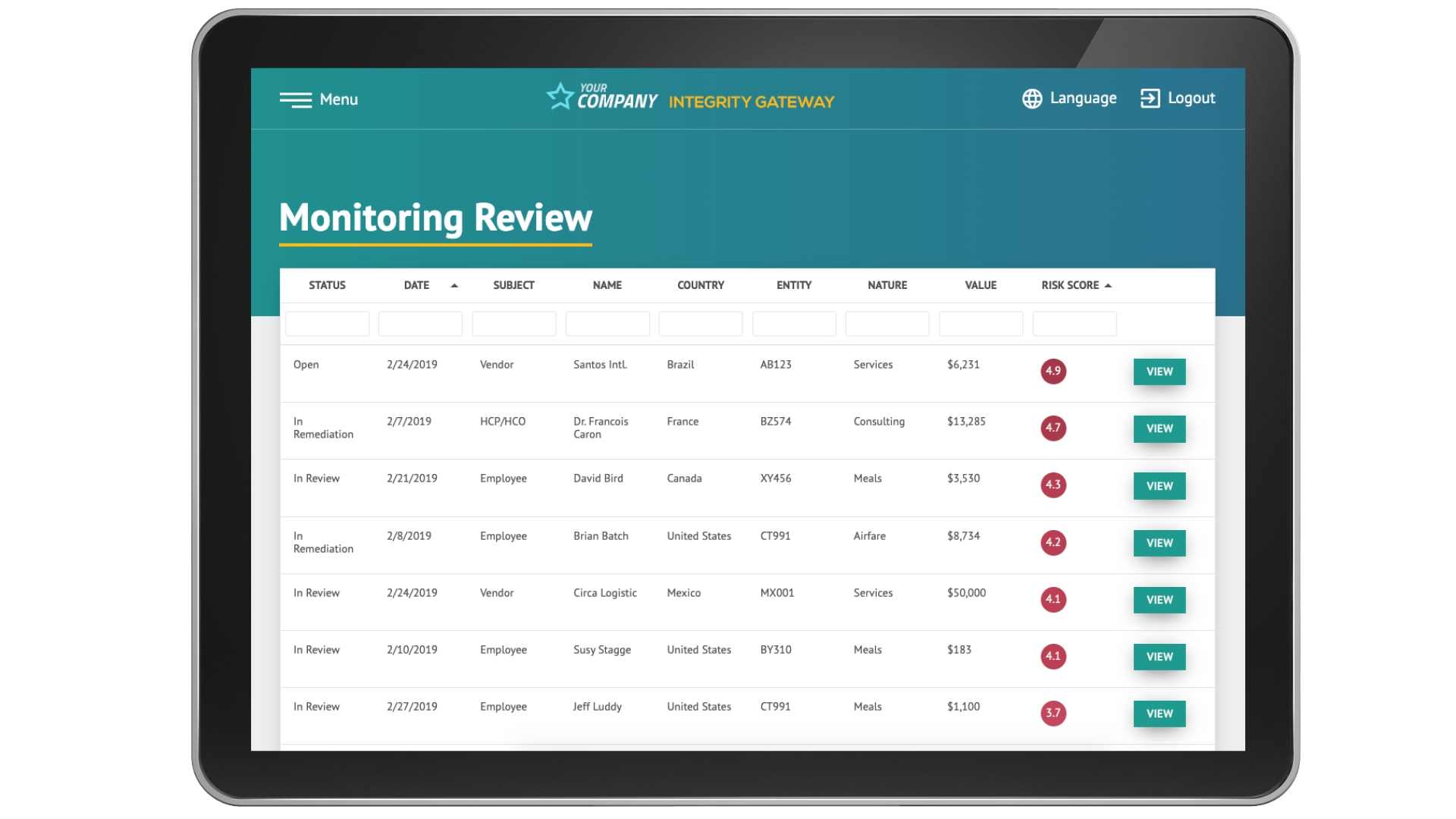

View and take action on transactions identified for review by the risk engine. Resolve quickly by seeing critical details about the transaction as well as the basis for the assigned risk score.

Push transactions that need further review into a workflow to document the resolution and any remediation, including comments and uploaded files supporting the resolution.

The results of your reviews are reported back to enhance the identification of risky transactions and improve the identification of false positives.

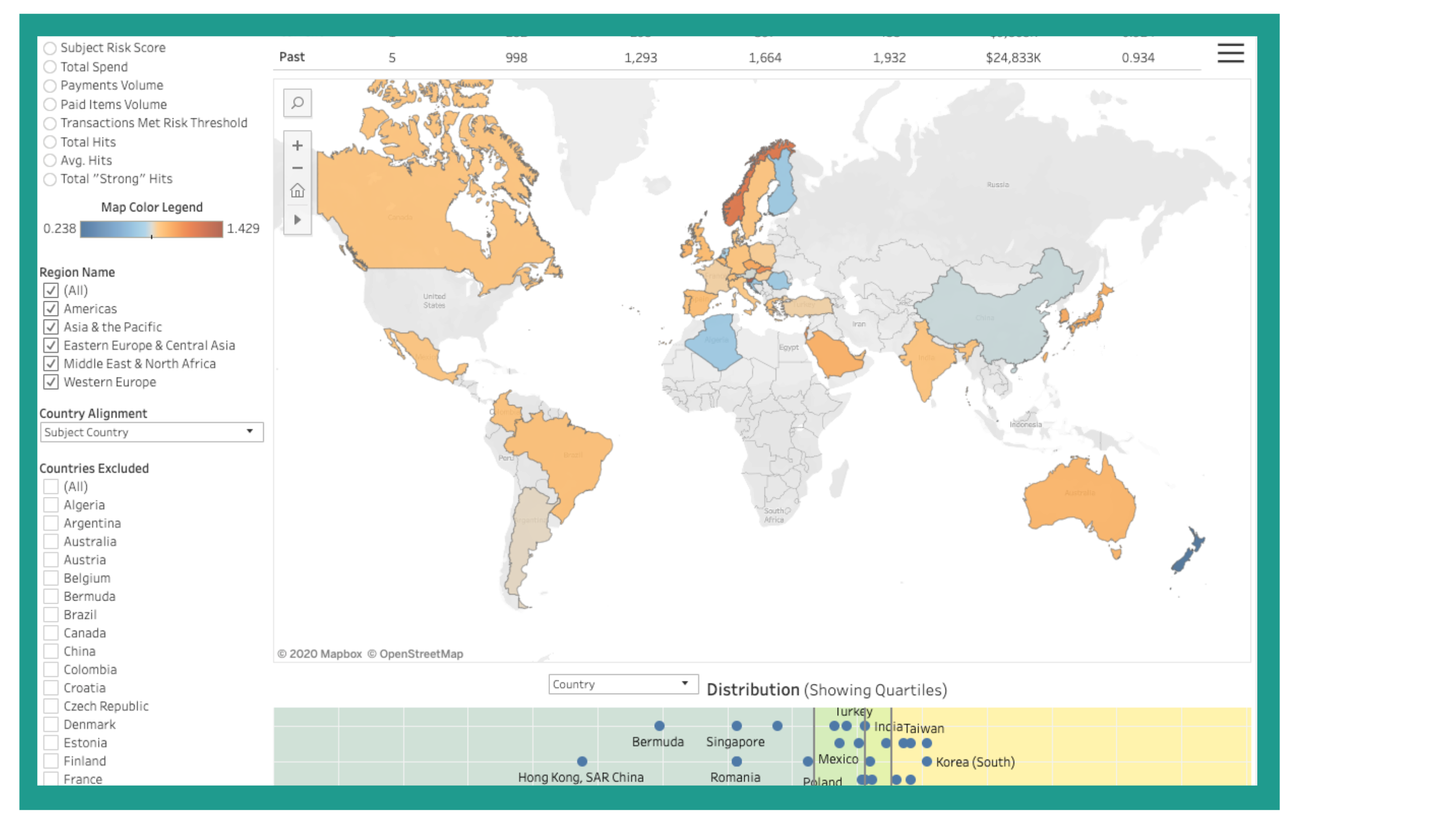

Gain insights from dashboards that enable you to view all spend and revenue data, highlighting key program metrics and exposing risk trends, patterns, and outliers. Deep-dive into specific areas of spend and revenue by third-party vendor or customer, employee, or location.

Visualize data and metrics related to your overall compliance program in one place to quickly assess the health of your program and empower business leaders to directly access risk insights of interest to them.

Export data in seconds for ad-hoc analysis or sharing. Export visualizations for Board and Compliance Committee presentations at the click of a button.

Enforcement agencies are intimately familiar with the quality and sophistication of Lextegrity’s Compliance Monitoring software. It has been before the U.S. DOJ and SEC on several occasions and was cited in an FCPA resolution by the SEC.

For one of our clients, the Compliance Monitoring software contributed to a DOJ declination, reduced SEC fine, and no imposition of a monitor or any self-reporting obligation as part of their resolution with the DOJ and SEC.

At its core, our continuous Compliance Monitoring software is user-friendly and accessible from nearly any device, making monitoring efforts less onerous and approachable for all types of professionals.

Our permissions are set up to grant access to users on a need-to-know basis, meaning data and dashboards are restricted in accordance with the user’s country to help comply with local data privacy restrictions.

From high-risk third-party vendors and customers to employee travel and entertainment, consolidate, monitor, and visualize your transactions and risk in one unified platform.

Our application is ISO/IEC 27001 certified, meeting the world’s highest standards for information security.

Our application and database are stored in Europe to support your GDPR efforts.

Our software is hosted on Amazon Web Services (AWS) with 24/7 security monitoring.

Our pre-designed risk algorithms allow you to roll-out a world-class continuous transaction monitoring program in weeks, with minimal effort.

Enable single-sign-on and integrate with leading HR, master data, and financial systems to make roll-out even smoother.

Our team will support you the whole way with training materials, train-the-trainer sessions, and 24/7 technical support for the application after go-live.

Continuously monitor your spend and revenue data with the Compliance Monitoring risk engine algorithm – incorporating advanced fraud detection techniques and machine learning – to identify anomalies and high-risk transactions that might impact enterprise risk.

Our application features a library of over 80 pre-built risk data analytics, from statistical to behavioral and policy-based. The analytics are configurable to fit your specific business, risk exposure, and historical issues your organization may have faced.

The tool connects to your ERP, T&E, Procurement, HR, and transparency data systems to risk score every transaction and escalate those with a higher risk profile for human review.

© 2023 Lextegrity Inc. All Rights Reserved. Privacy Policy